HOW CHINA IS REPLACING THE US DOLLAR WITH GOLD

Gold's full potential is about to be unlocked

In the previous newsletter, we have seen China’s dominance in the manifacturing:

With this newsletter today we are going to see how the endgame is going to take place. China has placed all of the pieces in the right spots of the chessboard we call world, conquering the manifacturing sector and now, as we will soon discover, also the cross payment and reserve systems. A method that will create cooperation. A different perspective from a US Dollar that has become a weaponized medium of exchange and a very fast depreciating reserve asset.

To do so, I will share with you the transcript from a recent Andrei Jikh Youtube video thats is super informative. The bottom line is that the entire world is reshaping completely around gold. Having gold, at this point in history will determine the future, and the future is clearly pointing towards gold.

Here is Andrei Jikh:

So for the last few years, China’s been doing something that hasn’t been done ever in modern history, which is to relink gold directly to its currency. So in simple terms, China wants to rebuild how money works. This is probably the most interesting story that you’re going to hear this year, and it caught my eye after watching a podcast by TFTC, and it blew my mind. Now, some people call this the debasement trade, but this is so much bigger than that. Here’s what’s happening. Over the last few years, the People’s Bank of China has been the biggest buyer of gold in the world. China and its allies, are buying gold and selling treasury bonds in order to damage the dollar’s reserve currency status. And at the same time that they’ve been buying gold. China’s also built something called the Shanghai Gold Exchange, which is already the biggest physical gold marketplace in the world. They just opened a new vault in Hong Kong, and they’re building what’s called the gold corridor, which is this network of vaults across the bricks countries, and it will allow those countries that hold the yuan to trade them in for physical gold. That gives China’s currency something that the dollar lost a long, long time ago: TRUST! Because gold can’t be frozen, can’t be printed. It’s much harder to debase, and it can’t default the same way that treasuries and dollars can. And as of July 2025 of this year, gold has officially been reclassified to what’s called a Basil 3 tier 1 asset. That means it now counts the same as cash or treasuries on a bank’s balance sheet. So the theory is that the next step is that gold will be upgraded again to what’s called an HQLA, a highquality liquid asset. That one change is going to unlock gold’s full potential that will let countries use it for something called repo and financing which is the foundation of the entire financial system. China has been systematically solving all the problems that countries had with using their currency. This is a theory of what’s about to happen to the world. There’s a parallel financial system that’s being built right now to compete with dollars. This goldback strategy will allow China to build a way to lend and to trade and to develop outside the dollar and outside the West. So, I want to help explain what’s happening to gold right now and why, what China’s gold corridor actually is and how it works, and how it’s going to be used to fund the development across the entire world without ever touching the IMF. Before I get into how China is rebuilding the entire financial system, I want to explain the bird’s eyee view of why the world is even looking at an alternative in the first place. And it really comes down to the idea of trust. The trust that countries used to have in dollars. For example, around 70% of all the global reserves were once stored in US dollars. In other words, countries held their wealth in US treasuries, bonds, right? Because they were considered to be the safest assets on Earth. But then that started to change sometime in 2022 because that’s when the United States froze about $300 billion worth of Russia’s foreign reserves. Now, regardless of how you feel about that politically, what it showed to the rest of the world was if your reserves are held in dollars, they’re not really yours to begin with. They can be seized, they can be locked, and we can just turn it off with a click of a button. So, countries are like, “Okay, I have a question: <“if you can do that to a nuclear power like Russia, what happens then if we disagree with you next?” So that’s why this change started to accelerate because there was this loss of trust for paper assets. Central banks around the world especially in what are called emerging markets started to lower their exposure to US assets and they started selling off their treasuries and they started buying gold instead. Slowly at first but then faster and faster. Check this out.

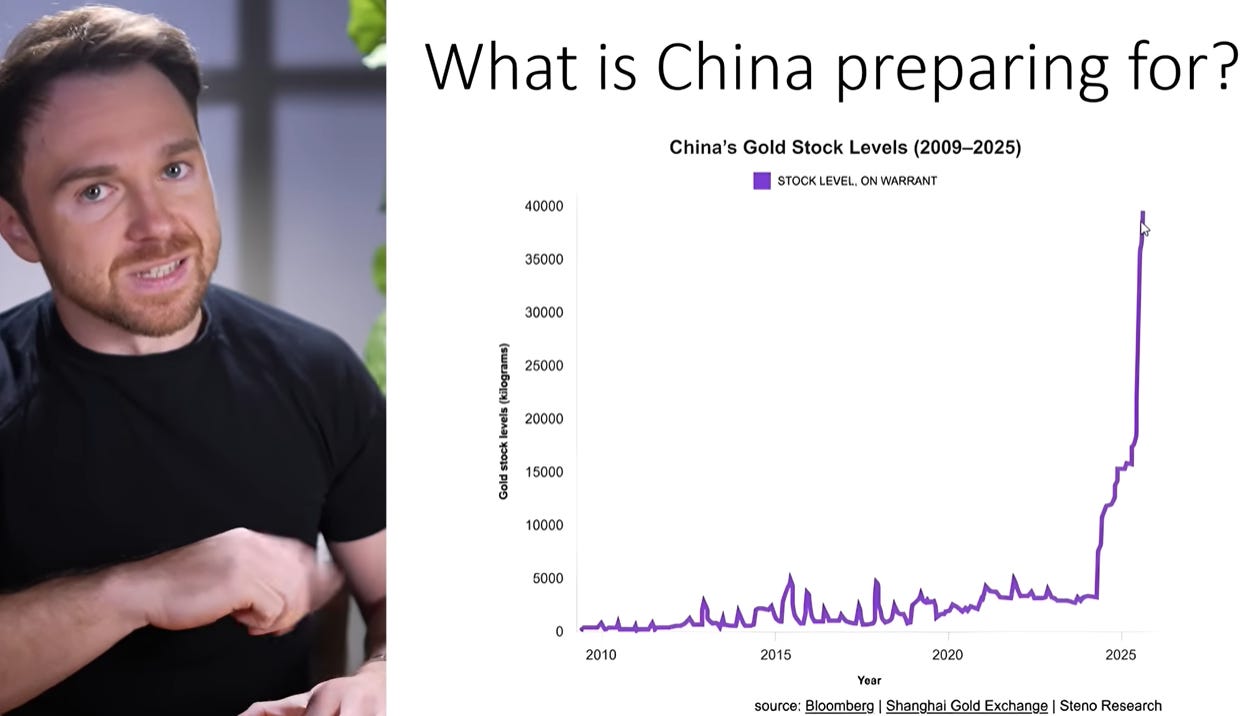

This is fascinating. This is a chart of how much gold China has been buying. For the longest time, you can see it didn’t really move anywhere. It’s kind of going sideways. They bought some, they sold some, they bought some. But as soon as President Trump started the tariff threats, the chart explodes, right? China starts publicly accumulating gold and locking it up in their vaults. It’s the fastest pace of buying in modern history. It’s being done on a scale that’s publicly, this is important, publicly visible to the rest of the world. Cuz remember, China could easily be buying this stuff in private, but they’re not. Because what that does is it telegraphs to all the other countries that, hey, look at all the gold we’ve got. “We could now get off of US treasuries. [

] That gives us the ability to get off of dollars”. You can actually see this trend on a way bigger scale here in this chart.

According to Luke Groman, in just a couple of months, gold’s share reserves on the balance sheet will surpass US treasuries. Again, just to prove the point even more, on an even longer time horizon, you can see the same thing has been happening: the dollar’s share of global reserves have been falling to the lowest levels in decades. By the way, officially the People’s Bank of China reports that they have about 2,300 tons of gold or so, but the real number is probably way higher.

Places like Bloomberg Economics and JP Morgan and the World Gold Council estimate that China probably controls closer to 5,000 tons when you include the gold held by state banks and sovereign funds that aren’t really publicly disclosed. Okay, so hopefully I’ve established the point that dollar ownership is going down, gold ownership is going up. But there was another major breakthrough that happened to gold that not a lot of people know about, which is that in July of this year, it became what’s called a Basil 3 tier 1 asset. So here’s exactly what that means. This is where it gets really interesting. For decades, gold was actually considered what’s called a tier three asset under the old Basil banking rules. So, what does that mean? Well, that meant that if a bank held, for example, let’s say a billion dollars worth of gold, it could only count about half of that value on its balance sheet. The system was literally designed to make sure that gold stayed something that banks stored and did not use. But then Basil 3 came along and it changed everything. Gold was upgraded to a tier 1 asset, which means that now banks can recognize 100% of its value. That’s a big deal. But here’s the thing. You still can’t lend against gold. You can’t borrow with it. You can’t use it for repo. By the way, repo is the short-term lending system that keeps the entire global financial system stable. It’s where banks borrow from each other overnight using treasuries. It’s complicated, but what it means is gold went from being a shiny rock to now a more valuable shiny rock with better accounting. Okay, but that’s where China stepped in because the next level above tier 1 is something called HQLA which stands for high quality liquid asset. These assets are so safe, so stable and so liquid that banks can actually use them as collateral in financing. Right now, those assets are basically US treasuries. It’s the plumbing behind every loan and repo and credit facility in the world. US treasuries are what’s used for the whole system. Now, if you’re a country and you want to build, let’s say, a a port or a factory or a power grid, you got to go to the central bank and you got to say, “Hey, I need to borrow some money.” And they’d be like, “Deposit some highquality liquid assets with us and then we’ll lend you the money.” Right? Now, again, that collateral is mostly US treasuries, which is also why the US dollar has played such a big role in the world. It’s the link to these treasuries. It is needed to borrow money. Okay? But imagine what would happen if gold was able to join that list. Gold would go from being a passive shiny rock to a thing that could be used to borrow, to lend, and to fund infrastructure with, all without ever touching the dollar. If gold becomes HQLA, countries will not need dollars to finance their economies anymore.

And that brings us to the BRICS summit that took place in May. So for years, China has been trying to convince the entire world, mostly the BRICS countries, Brazil, Russia, India, South Africa, to use the yuan in their trades. But everyone pushed back with the same question. This is hypothetical, but I imagine this is how their conversation was going based on what’s happening. China was like, “Will you guys use our currency, please?” And they’re like, “Okay, we’ll use your currency, but would mostly just rather use the dollar, but out of curiosity, what are you backing it with?” And China’s like, “Well, we’re backing it with our economy. We’re the factory of the world. It’s stable, but as an added perk, if you want, we’ll let you convert your yuan to gold anytime you want.” They’re like, “That’s cool. Okay, but where’s the gold going to be stored at?” China’s like, “China.” So all the other countries were like, “No, we’re good now. We’ve seen how that played out before with the US. We’re not going to trust you to hold our gold.” That was a conversation that was happening years ago. But at the most recent bricks summit, China had a lot of brilliant ideas to solve a lot of the problems those countries had with using the yuan. So here’s how China is going to get the developing world to use their currency. So the first problem that they’ve solved is trust. Because if you’re India or Brazil or South Africa, you’re not just going to take China’s word that they’re going to keep your gold safe, right? You want to see it, you want to touch it, and you want to store it somewhere that you could access. So, China built what’s now being called as the gold corridor. So, think of this as like an analog version of the blockchain, but instead of blocks verified by miners, it’s a network of gold vaults verified by nations.

Each vault is connected to the Shanghai gold exchange, the SGE, and it tracks every bar, its purity, its serial number, who owns it. So that one change fixes the problem of decentralization and trust because the gold custody is now geographically decentralized. It’s verifiable, redeemable, and honorable to an extent. Now, the second problem China had to solve was something called volatility, right? Because if you’re going to use a commodity like gold as collateral for things like loans, trade, or financing, you can’t have price swings every single day. You can’t have something that a nation with, let’s say, a ton of money could just manipulate the price of. So, here’s how they’re going to solve that. They’re solving it by using what’s called a moving average to stabilize the settlement price instead of using what’s called a daily price. In other words, instead of pricing gold by whatever it’s worth this morning, instead they might average it out over the last 200 trading days. So, whatever the price was on average over the last 200 days is the price. So that makes gold much more predictable, less volatile, and it smooths out the price risk for everyone using it. Now, here’s where it gets even more interesting. And this is the most likely thing that China is about to do next. This is what scares the US big time.

China is going to use this network, this system that it’s building to build other countries that need financing. So think about Africa for example. A lot of countries there are really rich in natural resources and commodities like gold. Africa produces between a quarter and a third of the world’s gold with more than half of the gold extracted on the continent in 2022 coming from artisal and small scale miners. But they don’t have the infrastructure under this system. Those countries will now be able to deposit their gold into the SGE, the Shanghai gold exchange, and then China through something like the New Development Bank, which is the BRICS Bank, they’ll be able to loan them yuan against their gold to build anything they like, roads, airports, power plants, whatever. China then gets to finance the development of and build influence and help countries go around the west and around the IMF, the International Monetary Fund, all while using gold as this high quality liquid asset. That’s where we come full circle, right? That’s how gold gets to HQLA regardless of what the West wants. So, gold goes from being just an expensive shiny rock that sits in a vault to an actual financial instrument that you can lend against, borrow, and build on. Now, so far, this is not official yet, but that seems to be where we’re going. And here’s where it gets even more interesting.

The United States knows exactly what’s happening. Like you’re not just finding out about this from me here on YouTube. So, do you remember how earlier this year the US started repatriating its gold from London back to the US? And I remember making a YouTube video about this and the official story was that it had to do with the tariffs or the big Doge audit, right? The US was calling its gold back because of the tariff trade or it was afraid that it was going to have a Fort Knox audit. But that never really made 100% sense to me. I think what’s really happening is that the US has known that all of this has been happening. That China’s been building its gold corridor. It’s expanding vaults across Asia, the Middle East, and Africa. And the US is like, “Okay, fine. We want our gold back, too.” Because if the world is moving toward a financial system where gold has to actually physically move and physically exist, not just on paper but for real and your partner countries demand the ability to redeem that gold, then custody or whoever holds that gold becomes everything, right? Who keeps the gold safe? So if the US wants to stay competitive in this new system, it needs to control more of its own gold physically instead of trusting it at someone else’s vault. Now officially the US holds roughly 8 tons of gold, maybe more, which is at this time the biggest stash of gold in the world. But a big portion of it was stored and accounted overseas for decades, mainly in London. So bringing the gold back to the US is a way for it to prepare for this new potential system without flat out saying we want our gold back cuz the dollar might not be around. So if gold does become a highquality liquid asset, if it’s allowed to be treated like treasuries, then whoever holds it physically has real collateral power to fund the rest of the developing world so that it can exert its influence on it. Okay? But now on a practical level, right, what does that mean for gold’s price? Right now, most financial institutions like for example central banks and sovereign wealth funds and pension funds, they keep somewhere around 20% of their reserves or their piggy bank inside of these gold or equivalent hard assets. But now there’s new guidelines being published at places like Bank of America, for example, and what they’re saying is that the amount of gold that should be held in reserves should be closer to about 30%. Now, that’s a 10% difference. Doesn’t sound like much, but across the entire global financial system, that is estimated to be about $2 trillion worth of new demand. Now, gold is not like the dollar, right? you can’t print more of it. So that $2 trillion of new demand could translate to a much much higher price of gold than we’ve ever seen before. Some people say that in 5 years we could see gold at double what it is today. Now I’m not personally making that prediction, but that is a very possible reality and it wouldn’t surprise me. So then the question is how will this affect investors and specifically something like Bitcoin? So when you look at this chess game that’s being played through this perspective, at least to me, it makes a lot of sense why something like gold or something like Bitcoin could have been suppressed in price for so long. Like if I were a country interested in both options as a possible alternative, why would I want the price of any of it to skyrocket until I had huge amounts of control over it? So I think what we’re seeing is a split. On one side you have China and the bricks building a world where money is again backed by something physical and old and something people can see and touch. And on the other side you have the US which is the world’s biggest exporter of paper money. And if China’s system is collateralized by gold, the US will eventually have to compete and counter with something that plays to its strength, which could also be its gold. I don’t know, but it could also be technology. In other words, if China is pairing its currency with something like gold, then the US could one day be paired with stable coins or maybe Bitcoin. Because think about it, both give you the same purpose in different ways. Gold represents trust through time because it’s thousands of years old. It’s physical. It’s slow. It doesn’t change much. And Bitcoin represents trust through energy and math. It’s digital. It’s transparent. It’s fast. It’s borderless. It has its own advantages. China’s system is about control and hard collateral. The US could also have an advantage through hard collateral but openness. So for the first time in modern history, I think we might be going into a world where governments have to compete for influence, for the better idea of what money is. And that’s something that has never happened before in history. In the past, there was always one global standard, one world reserve currency. But now we can be going into like this multimonetary phase of history where gold back money is led by China and bricks and the digital one led by the US and the west built around programmable assets, tokenized assets and maybe bitcoin. If that happens, money then becomes something countries and people can choose. Both are competing for versions of what comes after the dollar. And I actually think both can exist at the same time. And when if it happens, I think you could see both asset prices reprice very, very quickly. Now, when I say quickly, I don’t mean this year. That could mean 5 to 10 years from now, which is still considered very quick on these scales, but who knows?